Finally, the deduction underneath part 80G can not exceed your taxable income. for instance, When your income ahead of deduction is Rs 3 lakh and When you have offered donation of Rs 5 lakh towards the key Minister’s National Relief Fund, you should do not anticipate to say a lack of Rs 2 lakhs.

Our staff of reviewers are set up professionals with a long time of practical experience in places of private finance and maintain quite a few Sophisticated degrees and certifications.

a thousand+ NGOs Impacted we've been India’s most trusted and clear crowdfunding System, with a vision to make a social influence. Our exclusive design makes it possible for people from around the world to donate to elevating money for products expected by NGOs and charities in India, which might be then shipped to them by us. Facebook-file Twitter Instagram Linkedin-in Youtube Discover

12A & U/s. 80G. provided that the rely on follows the registration U/s. 12A, they're going to have the tax Best practices exemption certificate, and that is popularly called 80G certification. The government periodically releases a list of authorised charitable institutions and cash which are qualified to acquire donations that qualify for deduction. The checklist involves trusts, societies and corporate bodies incorporated underneath Section eight of the Companies Act 2013 as non-earnings corporations.

Donations with 100% deduction (Subjected to ten% of adjusted gross full income): Donations designed to regional authorities or government to market spouse and children scheduling and donations to Indian Olympic Affiliation qualify for deductions below this category.

He has actually been the CFO or controller of each smaller and medium sized providers and has run smaller firms of his very own. He has been a manager and an auditor with Deloitte, a big four accountancy organization, and retains a diploma from Loughborough College.

I wanna are aware that whether or not this donation volume is eligibe for a hundred% deduction u/s 80G devoid of making use of any qualifying limits.

a company Firm may give some products as charity to your charitable establishment or directly to individuals needing charity.

IRFC share priceSuzlon share priceIREDA share priceTATA Motors share priceYes financial institution share priceHDFC Bank share priceNHPC share priceRVNL share priceSBI share priceTata power share priceTata steel share priceAdani electrical power share pricePaytm share pricePNB share priceZomato share priceBEL share priceBHEL share priceInfosys share priceIRCTC share priceITC share priceJIO finance share priceLIC share priceReliance share priceHAL share priceJP electrical power share priceNBCC share priceTCS share priceVedanta share priceWipro share priceIOC share priceIrcon share priceSAIL share priceSJVN share priceGAIL share priceHUDCO share priceREC share priceReliance electricity share priceTata Technologies share priceVodafone plan share priceAdani Enterprises share priceAdani inexperienced share priceAdani Port share priceAshok Leyland share priceBank of Baroda share priceBSE share priceCanara financial institution share priceCDSL share priceCoal India share priceHFCL share priceIDFC to start with lender share cost

Observe: This deduction will not be accessible if someone taxpayer opts to pay for taxes under the new tax routine (115BAC).

just before this rule, the government couldn’t very easily confirm if the donation details furnished by donors were correct. So, to carry more transparency, the tax authorities manufactured a rule in March 2021.

In addition, it is crucial to note that type 10BE have to be downloaded from the income tax portal and not developed manually by the establishment or NGO.

price range 2023 presented that donations produced to the next money won't be suitable for just about any deductions underneath 80G:

– For saying deduction below part 80G, a receipt issued through the receiver trust is essential. The receipt will have to incorporate the name and address of your have confidence in, the name of the donor, the quantity donated (please ensure that the amount prepared in phrases and figures tally).

Danny Tamberelli Then & Now!

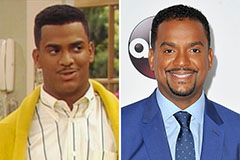

Danny Tamberelli Then & Now! Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Kenan Thompson Then & Now!

Kenan Thompson Then & Now! Phoebe Cates Then & Now!

Phoebe Cates Then & Now! Tyra Banks Then & Now!

Tyra Banks Then & Now!